Learn/Get Started with Webull/Establishing Regular Savings Plans with US Stocks and ETFs and Embracing Mutual Funds

Establishing Regular Savings Plans with US Stocks and ETFs and Embracing Mutual Funds

You can conveniently and effectively manage your investments by establishing a Regular Savings Plan (RSP).

Establishing Regular Savings Plans with US Stocks and ETFs and Embracing Mutual Funds for Time-Strapped Singaporeans

In today's fast-paced world, juggling multiple responsibilities often leaves little time for financial planning. However, we have a solution for busy individuals in Singapore looking to build financial discipline and secure their future. You can conveniently and effectively manage your investments by establishing a Regular Savings Plan (RSP) with US stocks, ETFs, and mutual funds. Let's explore the key features and benefits of RSPs with mutual funds.

Advantages of Webull's Regular Savings Plans

- Convenient Investment Methods: RSPs offer flexible investment options such as Electronic Direct Debit Authorisation (eDDA) or Buying Power of your margin or cash account. These streamlined methods simplify the investment process, allowing you to seamlessly transfer funds from your designated account to your chosen stock, ETF, or mutual fund.

- Auto-FX Conversion: RSPs often include an automatic currency conversion feature, eliminating the need for manual conversions. This saves you time and effort by converting your SGD deposits to the traded currency of the underlying asset. For Webull, this automatic currency conversion feature is only applicable to eDDA deposits for RSP.

- Multiple Investment Frequencies: With RSPs, you can choose the investment frequency that aligns with your financial goals and circumstances. Whether you prefer daily contributions or monthly deposits, RSPs accommodate various intervals, allowing you to customize your investment schedule.

- Low Initial Investment: Regular Savings Plans offer the opportunity to start investing with as little as USD 1 and SGD 1 for Cash Funds, making it accessible to individuals with modest budgets. Additionally, you can now begin investing in US stocks and ETFs for as low as USD 5, expanding the options for aspiring investors.

- Extensive Mutual Fund Options: Webull provides access to a remarkable range of over 380 mutual funds SGD and USD classes through more than ten globally and locally renowned asset managers licensed by the Monetary Authority of Singapore (MAS). This diverse selection empowers you to customise your investment strategy according to your risk tolerance and financial objectives.

How to customize your own Regular Savings Plan at Webull?

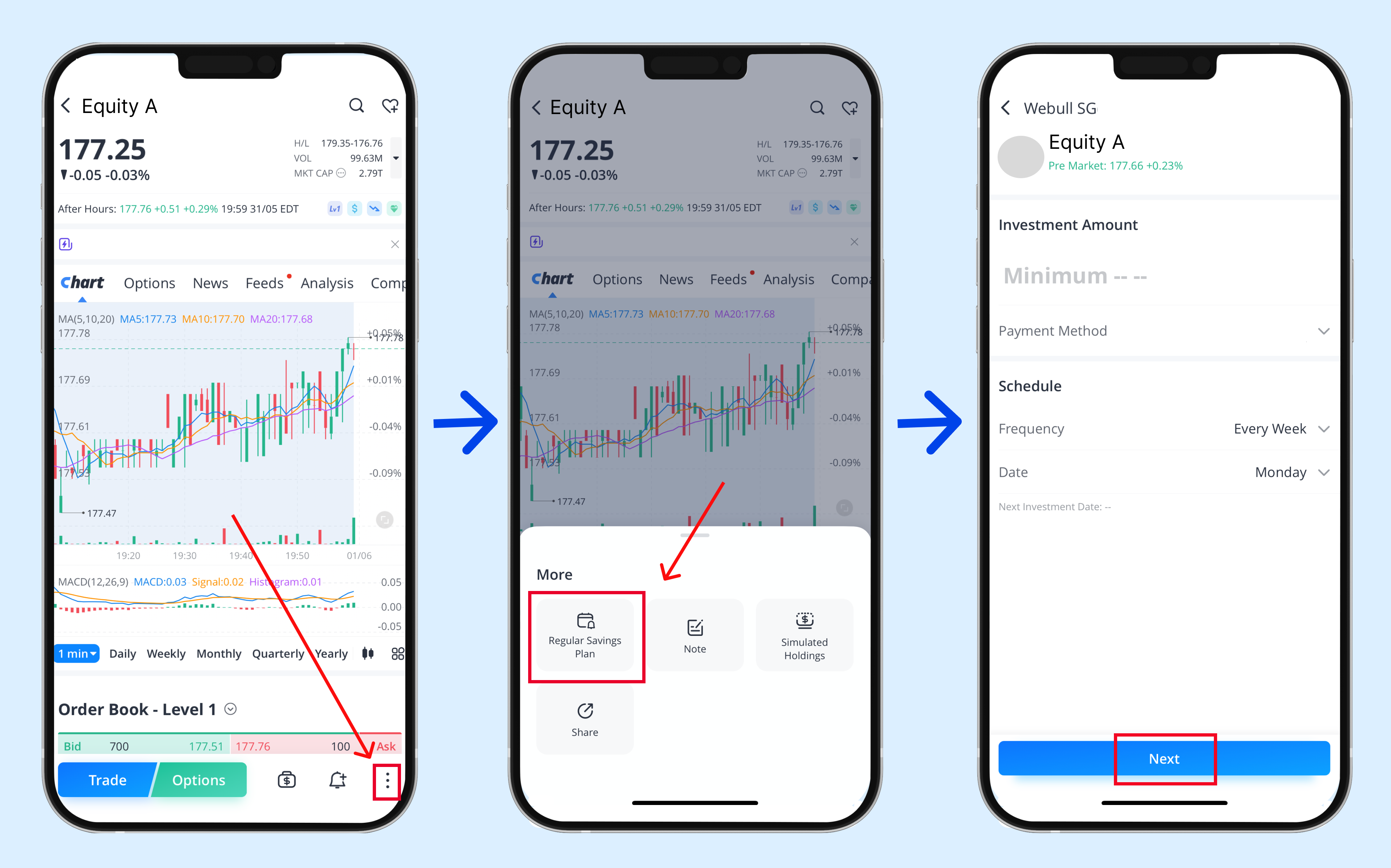

For US stocks/ETFs: RSP card or 3 dots button at Individual Stock Details Page>RSP

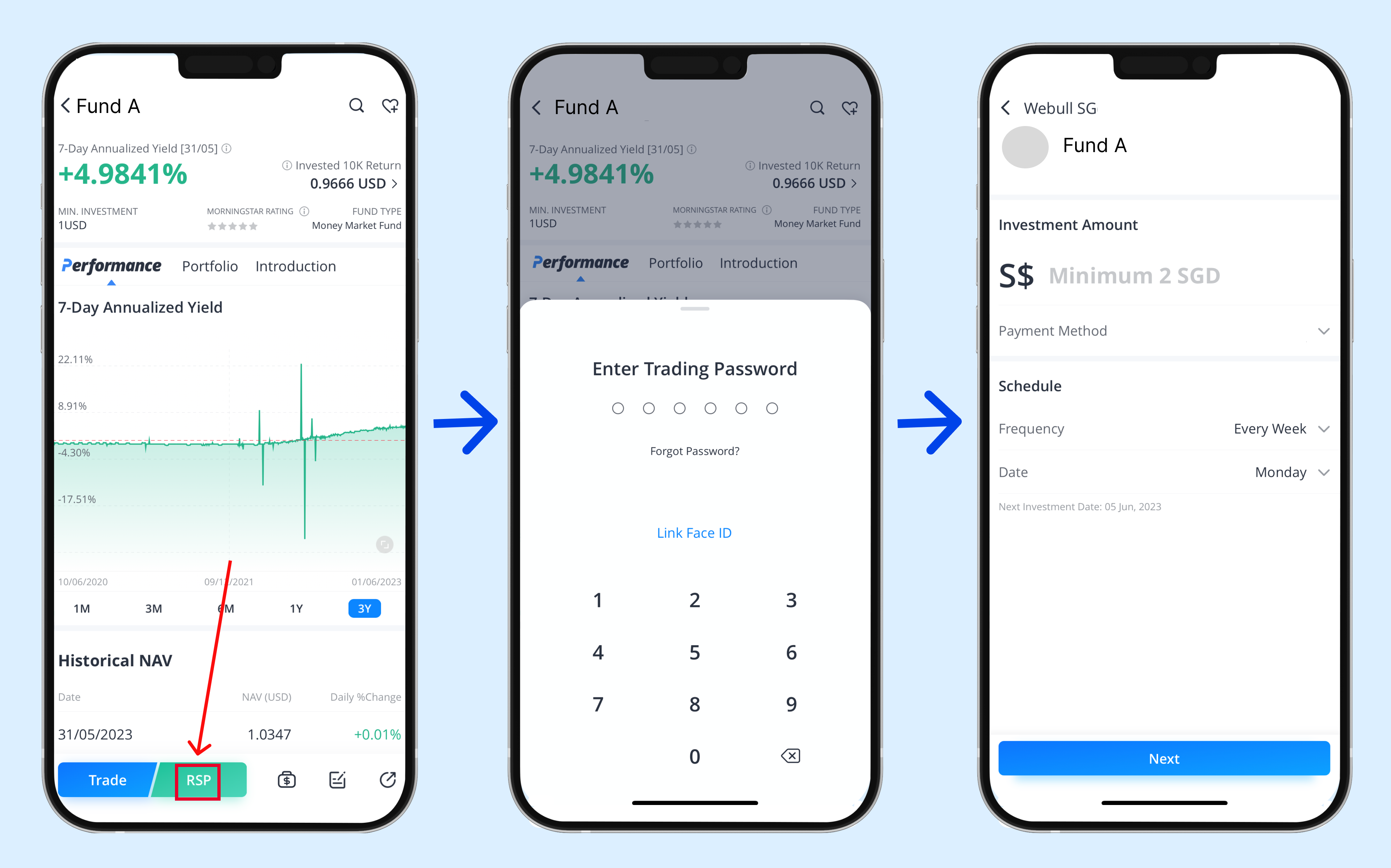

For Mutual Funds: RSP button at Mutual Fund Details Page

Click to set up your RSP for Mutual Funds>>>

Just set it up and enjoy your investing at Webull!

0

0

0

All investments involve risks and are not suitable for every investor. The value of securities may fluctuate and as a result, clients may lose more than their original investment. No content should be construed as investment advice or recommendation, or an offer or solicitation, to deal in any investment product.

Lesson List

Establishing Regular Savings Plans with US Stocks and ETFs and Embracing Mutual Funds

2

Debunking Myths: The Right Time to Buy with a Regular Savings Plan

3

Should I subscribe to a Regular Savings Plan for Mutual Funds or Exchange Traded Funds (ETFs)?

4

How to Open a Webull Account

5

How to Use Stock Screeners

6

How to Create Alerts

7

How to Manage Your Watchlists