0DTE Options

Understanding Option Pricing Over Time

If you compare similar options contracts with different expiration dates, you’ll notice that shorter-term options are cheaper than longer-term options at the same strike price. This is because more of their time value has depleted. It follows that 0DTE options, as the shortest-term options available, have the lowest premiums of any options at a given strike price, all else being equal.

At-the-money 0DTE options can be powerful leverage tools, as their lower relative prices carry potential to achieve higher percentage returns. A small favorable price movement may cause the option’s value to move upward significantly, benefitting investors who hold the long position on that option. By contrast, an unfavorable price movement can quickly wipe out gains or deepen losses.

Typical Pitfalls in 0DTE Options

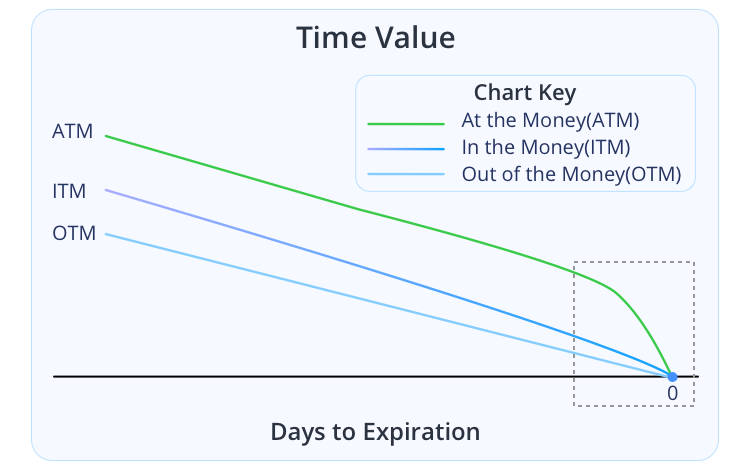

Understanding the impact of time decay is critical to avoiding some common pitfalls in options trading. On the time decay curve below, the rate of decline in time value generally accelerates as the option approaches expiration, especially for at-the-money options: This has stark implications for the risk-reward profile of these assets.

Yes, you can potentially achieve high percentage returns by buying short-dated options, but that also tends to be where the highest degree of risk occurs. Since there is less than one day left with accelerating time decay, the lack of flexibility in position management is another issue for the option holder.

If you decide to buy 0DTE calls or puts to speculate on price movement, keep in mind that time is working against you. You'll typically need the stock to make a sizeable move in a short time to make a profit, especially for the cheaper OTM options.

Bottom Line: Position Management

Position management is vital to using 0DTE options effectively. It is true that buying a 0DTE option contract is relatively cheaper than at longer expirations, and the loss is limited to the premium paid. But on such a short timescale, the margin for error is slim. Your gains or losses will happen quickly, and you should take extra care when making the decision to handle these assets.

0DTE options can be tempting, but they will not fit every investor’s risk tolerance.

Source: https://www.webullapp.com/learn/O8rt8I/NhFsOm/0DTE-Options?sourcePage=InvestEducationLessonDetail

Disclaimer: Options trading involves significant risk and is not suitable for all investors as investors may be exposed to potentially rapid and substantial losses. Options trading functionality is subject to Webull Securities' review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.