Triple Witching Day in June 2024: Insights and Actions

Do you know that the upcoming triple witching day falls on this Friday, 21 June 2024. On the day of triple witching, when three types of derivatives contracts simultaneously expire, the U.S. market typically experiences higher trading volume and may show increased market volatility.

What is Triple Witching Day?

Triple witching day refers to a trading day on which three types of derivatives contracts – stock options, stock index options, and stock index futures – expire simultaneously. Happening four times a year, triple witching days fall on the third Friday of March, June, September, and December.

In the folklore, the name “witching” is symbolic of certain times when dark, supernatural forces are active. Derivatives traders have applied this name to the date of contract expiration when traders are forced to unwind large derivative positions. The word “triple” comes from the three types of contracts expiring simultaneously: stock options, stock index options, and stock index futures.

In 2024, the four Triple Witching Days are: 15 March 2024, 21 June 2024, 20 September 2024, and 20 December 2024.

Why it Matters to Investors

For investors, Triple Witching Days are important because it can impact the trading volume and pricing of stocks and indexes.

When options approach their expiration, traders need to decide whether to close the positions, roll them over, exercise the options prior to triple witching, or just let them expire. For example, if a trader holds 10 option contracts that expire this week, he/she can roll them over by selling the option contracts before expiration and buying another 10 option contracts that expire next week to delay assignment. Trading volume typically surges on triple witching days. On triple witching day, when traders exercise the options or let the options expire in the money, there will be buying or selling of the underlying security, and thus the trading volume of the symbols will increase.

To conclude briefly, the simultaneous expiration on the triple witching day nudges traders to actively trade before expiration. Since contract expiration leads to buying and selling of underlying assets, the trading volume increases on triple witching days.

In addition, when trading volume sharply increases, volatile price swings could potentially occur, and the prices of the underlying stocks or indexes may change rapidly within a short period of time. The increased trading volume and market volatility on the triple trading day also require the investors and traders to pay attention and act cautiously.

Historical Market Performance: Triple Witching Days on 15 December 2023 and 15 March 2024

The last two occurrences of Triple Witching Day were on 15 December 2023, and 15 March 2024.

On 15 December 2023, the last triple-witching day of 2023, trading volume was 19.76 billion shares, compared with the 11.80 billion average for the full session over the last 20 trading days. Up to $5.4 trillion of index options, ETF options, options on futures, and single stock options (collectively known as Options) were due to expire on 15 December 2023 as per the Bloomberg report.

On 15 March 2024, the first triple-witching day of 2024, trading volume on U.S. market exchanges was 18.76 billion shares, compared with the 12.40 billion average for the full session over the previous 20 trading days. It was the year's highest trading volume from January till then on U.S. exchanges. About $5.3 trillion of Options were set to expire on 15 March 2024 as per the Bloomberg report.

Similarly, several indexes, IXIC for example, also recorded quarterly high trading volume in Q4 2023 at 2.12x and Q1 2024 at 1.86x in comparison to the quarter's next highest volume.

Figure 1: Trading Volume of IXIC on 15 December 2023 and 15 March 2024

(Source: Webull Desktop App)

Disclaimer: Image is for illustrative purposes only. Not financial advice.

Things Investors Should Look Out for During Triple Witching Day

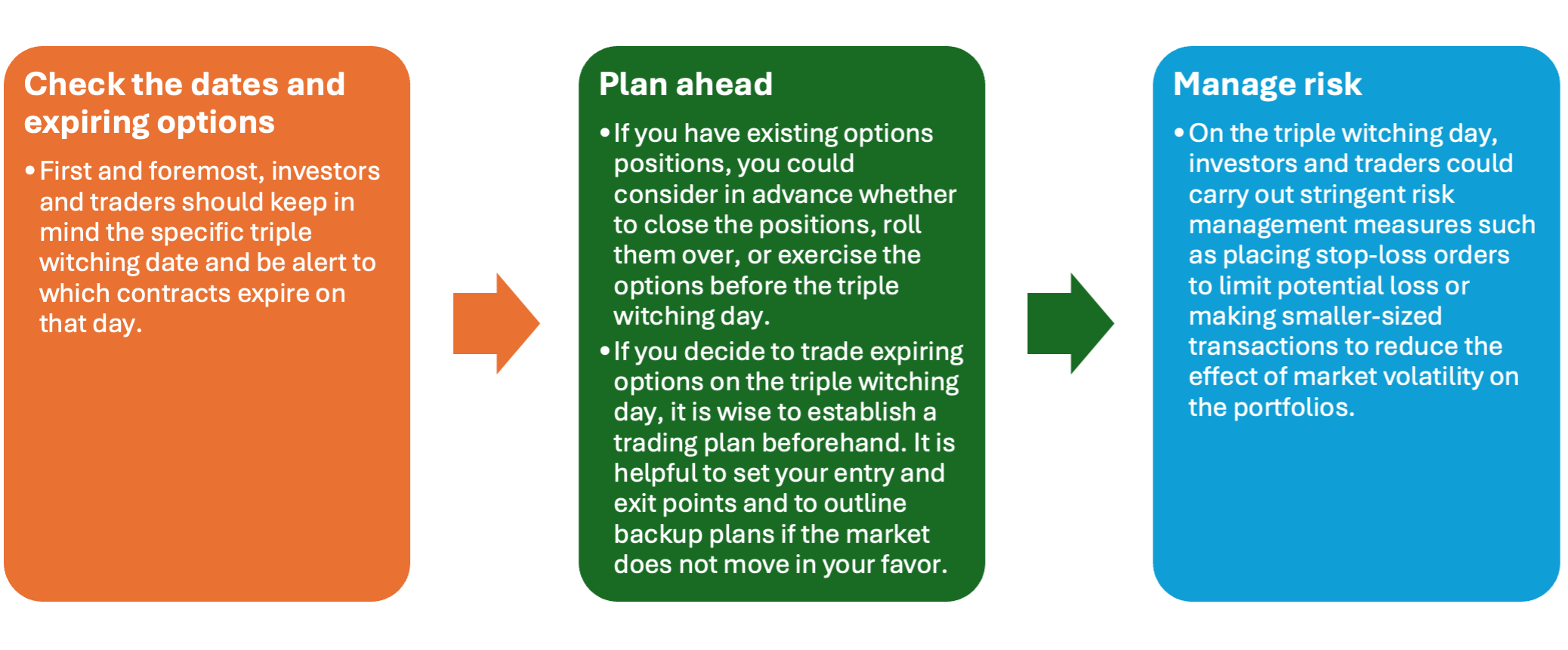

Due to the simultaneous expiration of three types of contracts and increased trading volume, triple witching day could be demanding to navigate. Investors and traders could refer to the following tips to strategize their investments in advance.

In addition, if you are new to triple witching, practicing it with our Webull Paper Trading simulated trading environment is recommended. This allows you to hone your strategies without the risk of financial loss on the triple witching day.

Summary

Triple Witching Day is a quarterly event when three types of derivative contracts expire simultaneously on the third Friday of March, June, September, and December. Investors and traders should be aware of the triple witching day since it can lead to increased trading volume and market volatility when a large number of contracts expire on the same day. By monitoring the market behaviour and planning the trading strategies, investors and traders can better navigate the trading environment on the triple witching day.

What’s more, if you are an options trading enthusiast and want to trade 0DTE options on Triple Witching Day, stay tuned! In the next article, we’ll dive deeper into the Webull 0DTE options center – you won’t want to miss it!

References:

1. https://www.investopedia.com/terms/t/triplewitchinghour.asp

2. www.investopedia.com/terms/q/quadruplewitching.asp

3. https://www.nasdaq.com/articles/everything-you-need-to-know-about-rolling-options

4. https://www.reuters.com/markets/us/futures-gain-rate-cut-cheer-persists-2023-12-15/

5. https://www.bloomberg.com/news/articles/2023-12-15/a-5-trillion-option-expiry-looms-as-s-p-500-eyes-all-time-high

6. https://www.reuters.com/markets/us/futures-nearly-flat-ahead-fed-meet-next-week-2024-03-15/

7. https://www.bloomberg.com/news/articles/2024-03-14/stock-market-today-dow-s-p-live-updates

8. https://www.tastylive.com/concepts-strategies/triple-witching