Three Ways to Use Options in Your Portfolio

Options can be risky, but they don't have to be daunting. With proper education and understanding of options strategies, you will find that they can open up many new opportunities. Let’s discuss three basic ways to use options in your portfolio.

Hedge Your Positions

When you own a car or a house, you usually purchase an insurance policy to cover losses from potential accidents. If you own stocks, is there a way to protect yourself from a price crash? In financial jargon, a hedge is an investment that attempts to offset potential losses from one asset with potential gains in another.

For example, someone who owns shares of one stock might buy puts or sell calls in that underlying stock. A long put can hedge a position for the duration of the option, while a covered call can partially offset any losses by the amount of the premium earned. Long puts tend to be the more popular means of hedging with options, as the risk is limited to the premium paid. Selling a call generates a small amount of income in the form of a premium received but carries the risk that the call will be exercised, and you'll have to sell the position you wanted to protect.

An investor having made a short sale of shares can buy a call option on the underlying security to protect himself from unfavorable price fluctuations. The call option effectively protects against a rise in the market price of the security sold short since it establishes the maximum price to be paid to buy back the shares.

Selling Options for Income

At first, options selling strategies can be daunting—the options seller has the obligation to buy/sell the underlying security at the strike price, no matter how low/high the price is. It sounds risky! No wonder options selling strategies are often referred to as "picking up pennies in front of a steamroller."

But when it comes to selling call options on your own stocks (covered call strategy ) or selling puts on your idle cash (cash secured put strategy), it becomes a different story. While they still carry some risk, these two strategies can help investors generate additional income, achieve a higher probability of success, and reduce the volatility of returns in their portfolio.

Of course, there are more option strategies available on Webull to sell options, which are useful in a variety of market environments. The more you learn about options, the more amazed you will be by the many opportunities they can provide.

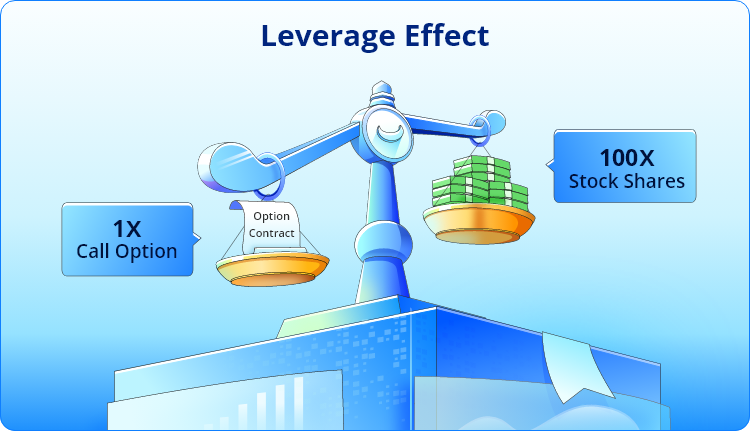

Options Provide Leverage

An options buyer can pay a relatively small premium for market exposure in relation to the contract value (usually 100 shares of the underlying stock). An investor can have a significant percentage gain from comparatively small but favorable price movements in the underlying security.

Leverage also has downside implications for options buyers. If the stock price does not move as anticipated during the option's lifetime, the option may expire with no value. The loss can be the entire amount of the premium paid for the option.

The leverage effect in options trading is a double-edged sword. It provides a cost-efficient way to establish positions with great leveraging power.

Next Step

Options are a relatively complicated investment tool and require more work than typical stock trading. A basic understanding is just the beginning if you want to explore the world of options trading.