Overcoming the Misconceptions About Options

Myths and misconceptions arise from a lack of understanding. This is true of most things, and it’s true of options trading. That's what Webull Learn is hoping to change. With easily digestible content, you can educate yourself in areas where you might not know as much as you’d like, including options.

You should know the risks involved before trading options. But it’s also helpful to know that options can be used to hedge existing risks, or to provide opportunities to enhance risk-weighted returns in your portfolio. Even if you’ve learned about options in the past, you may still hold some misconceptions.

Misconception 1: Options are only used for speculation

You CAN use options to speculate on price movement, but this is not the only reason why people use them.

Options can provide leverage. For example, instead of investing $1,000 in a stock, you can buy options on that stock for a much smaller premium, gaining access to the same position and potential returns, but limiting your risk to the premium.

Options can also help investors hedge risks or generate additional income for their portfolios. Options can help meet many different investment objectives, and each strategy has its own risk/reward profile.

Misconception 2: Options expire worthless, so they're a bad investment

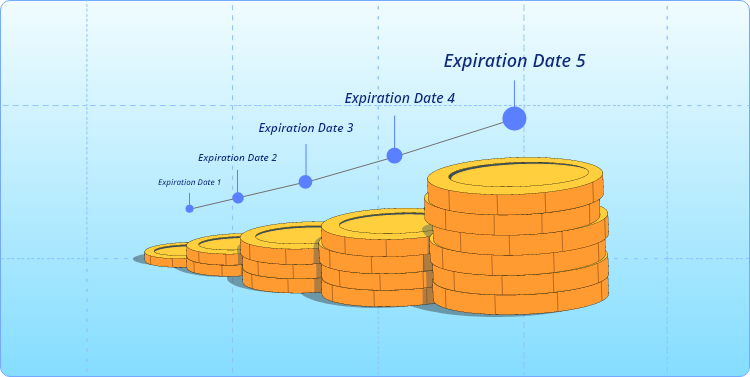

One big difference between stock options and the stock itself is that all options contracts will eventually expire, but you can hold stocks as long as you want.

Options contracts will expire worthless if they are out of the money at expiration. But up until expiration, an option contract can be bought or sold like any other asset, and you can realize a profit/loss by closing your existing options positions before expiration without exercising them. If the contract has intrinsic value, it can be a good investment for a time, even if it expires worthless later on.

Misconception 4: Options are too hard to understand

Learning about options takes effort, but there are tools available to help you grow in knowledge and understanding. You won’t master every options strategy all at once, and some are only suited to seasoned options investors—but with time, patience, and the willingness to learn, you can work your way up to a higher level.

Learning to invest begins with understanding your own needs and risk tolerance. If you want to use options to improve the income return on your portfolio, learn the basics of the covered call strategy. If you want to use options to protect your portfolio from a bear market, understand the mechanisms of a protective put.

Options are not suitable for everyone. Still, they can effectively manage risk or produce income in the right scenarios. If you want to learn more about options, understanding the truth about these misconceptions is just one step to increasing your knowledge about them.