What to Know Before Trading Options?

Have you ever had the following questions?

- Can I buy insurance for my stocks just like my car insurance?

- How can I improve my returns while the stock price remains stagnant?

- Is there a method to lower the upfront cost for those expensive stocks?

With understanding and proper application, options trading can get investors where they want to be. However, we still need to be careful of its inherent risks. Here is an overview of what you need to know before trading options.

What is an option?

An option is a contract that gives the owner of the contract the right to buy/sell the underlying asset at an agreed upon price by a specific date.

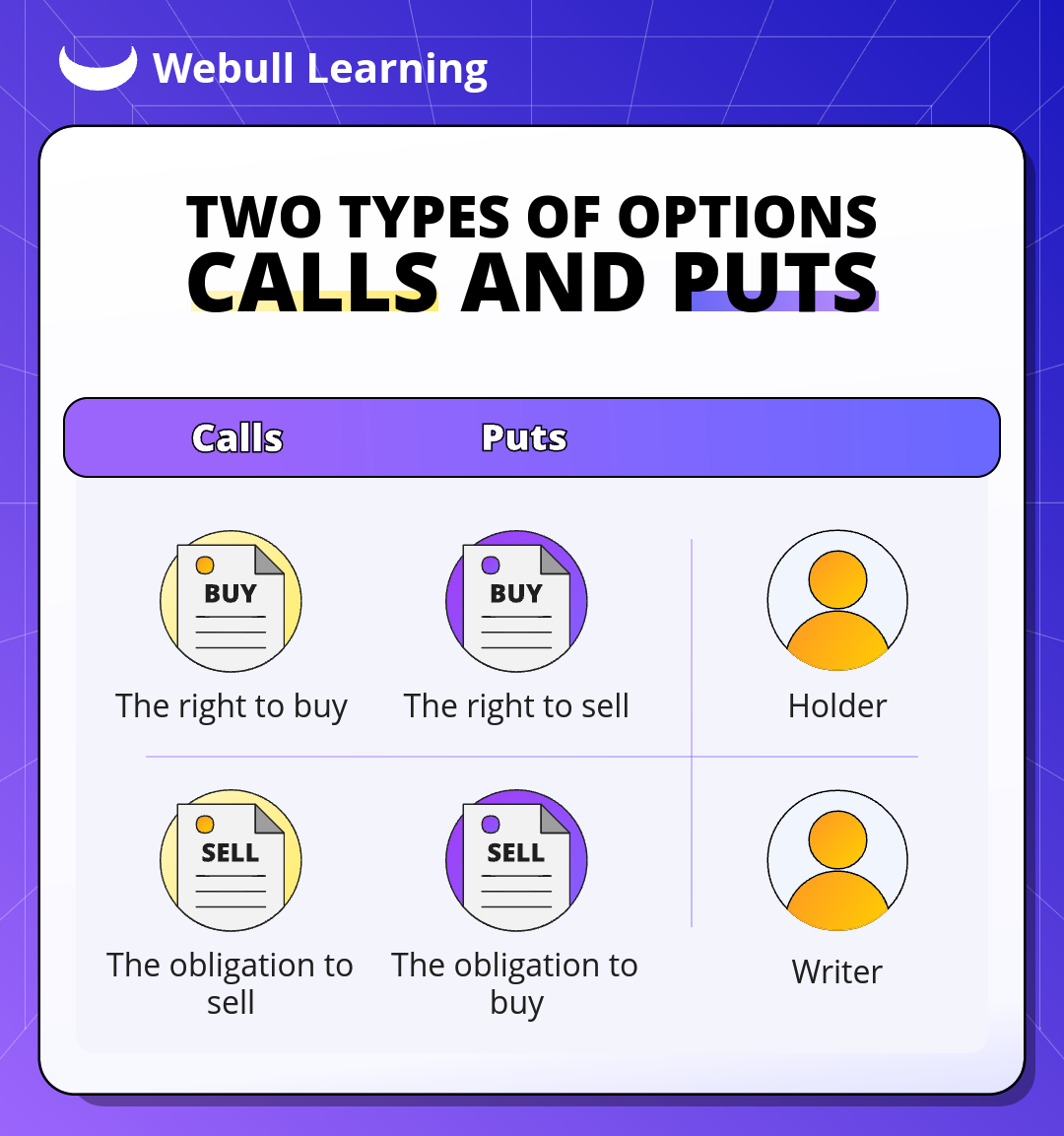

- You will have the right (no obligation) to trade the underlying security at the agreed price when you buy an option. Therefore, you are called the option buyer or holder.

- Conversely, the option seller (also called the writer) is obligatedto trade the underlying security with the option buyer if the buyer decides to exercise their right.

The different types of options

There are two types of option contracts:

- Call option: gives the buyer the right to buy the underlying asset.

- Put option: gives the buyer the right to sell the underlying asset.

Key elements in an option contract

1. Underlying Asset

Underlying asset refers to the assets exchanged if the options are exercised.

Stock options generally have a multiplier of 100 shares, so one options contract will generally represent 100 shares of the underlying stock. For example, a call option on XYZ Company gives the holder the right to buy the 100 shares of XYZ Company.

2. Strike Price

The strike price (or exercise price) refers to the pre-determined price the underlying asset can be bought or sold for.

Suppose an investor buys one call option on XYZ Company at the strike price of $150. The buyer can buy the XYZ company at $150 per share if they exercise the right.

- If the strike price is higher than the current market price, it is not economical for the owner of the contract to exercise their right to purchase shares at the strike price as they would be paying more for the shares opposed to buying the shares in the market.

- If the strike price is lower than the current price, in this situation, you would be purchasing the shares for a discount compared to what the shares are trading at in the market. You need to pay a premium to own the contract and the premium paid for the contract should be considered when deciding whether to exercise the contract or not.

3. Expiration Date

Options do not exist forever — they all have an end date. Therefore, an expiration date refers to when the option contract expires.

As an option approaches the expiration date, the option buyer will decide whether to:

1) sell the option contract to realize the profit or loss;

2) exercise the option if it is economical;

3) let the option expire and lose all the premium paid.

4. Premium

An option premium is a price that investors pay for a call or put option contract.

Compared to stock trading, options trading might be less liquid and have lower trading volume in some cases. It is essential to pay attention to the bid-ask spread, which might be your implicit transaction costs.

5. Exercise Style

There are two option styles in the markets:

- European style options can only be exercised on the expiration date. Most index options are European style.

- American style options can be exercised at any time on or before expiration. Stock options and ETF options are American style.

Before we get started, you'll need to know the essential elements of the option contract. After you are well versed in how it works, it will be easier to grasp the key details when seeing the options chain.

Four basic options trading strategies

Once you've comprehended the basic concepts, you might be interested to know how to apply options trading. Here, we introduce you to the four basic option strategies. Also, we highly recommend you use the paper trading function to practice before using real money.

1. Long call strategy

An investor who buys a call option hopes to profit from the increase in the underlying asset price.

The maximum loss the investor can incur by purchasing a call option is the premium paid to open the position. However, the call buyer has unlimited upside potential gains because the underlying security price can theoretically go up without boundary.

2. Long put strategy

An investor who buys a put option hopes to profit from the decrease in the underlying asset price.

The maximum loss the investor can experience is the full premium paid to open the position. However, the put buyer has substantial upside potential because, theoretically, the underlying price can go to zero.

3. Covered call strategy

An investor who sells a call option while simultaneously holding the underlying security hopes to collect premiums from the sale of call options.

The potential profit is limited to the strike price minus the current stock price plus the premium received if the call is assigned. But the potential loss is substantial because of the downside risk of owning the stock.

4. Cash secured put strategy

An investor sells put options while simultaneously posting cash as collateral, aiming to collect premiums from the sale of put options.

Potential profit is limited to the premium received from selling the put. However, the potential loss is substantial but limited to the strike price if the stock goes zero.

Next Step

Options are a relatively complicated investment tool and require more work than typical stock trading. A basic understanding is just the beginning if you want to explore the world of options trading.

The paper trading function helps practice trading options and leaves your novice status behind. As you become more comfortable with basic options trading strategies, more advanced strategies might meet your investment goals.